The impact on GDP

First, let’s look at the big picture – the US GDP before the pandemic hit and how the economy has reacted to the coronavirus.

“The Covid-19 crisis has knocked back the US economy and it seems unlikely to recover the pre-crisis trend rate. Given the scale of the borrowing needed to help the economy, it looks like a slower recovery in GDP will take place,” comments Chris Beauchamp, IG’s chief market analyst.

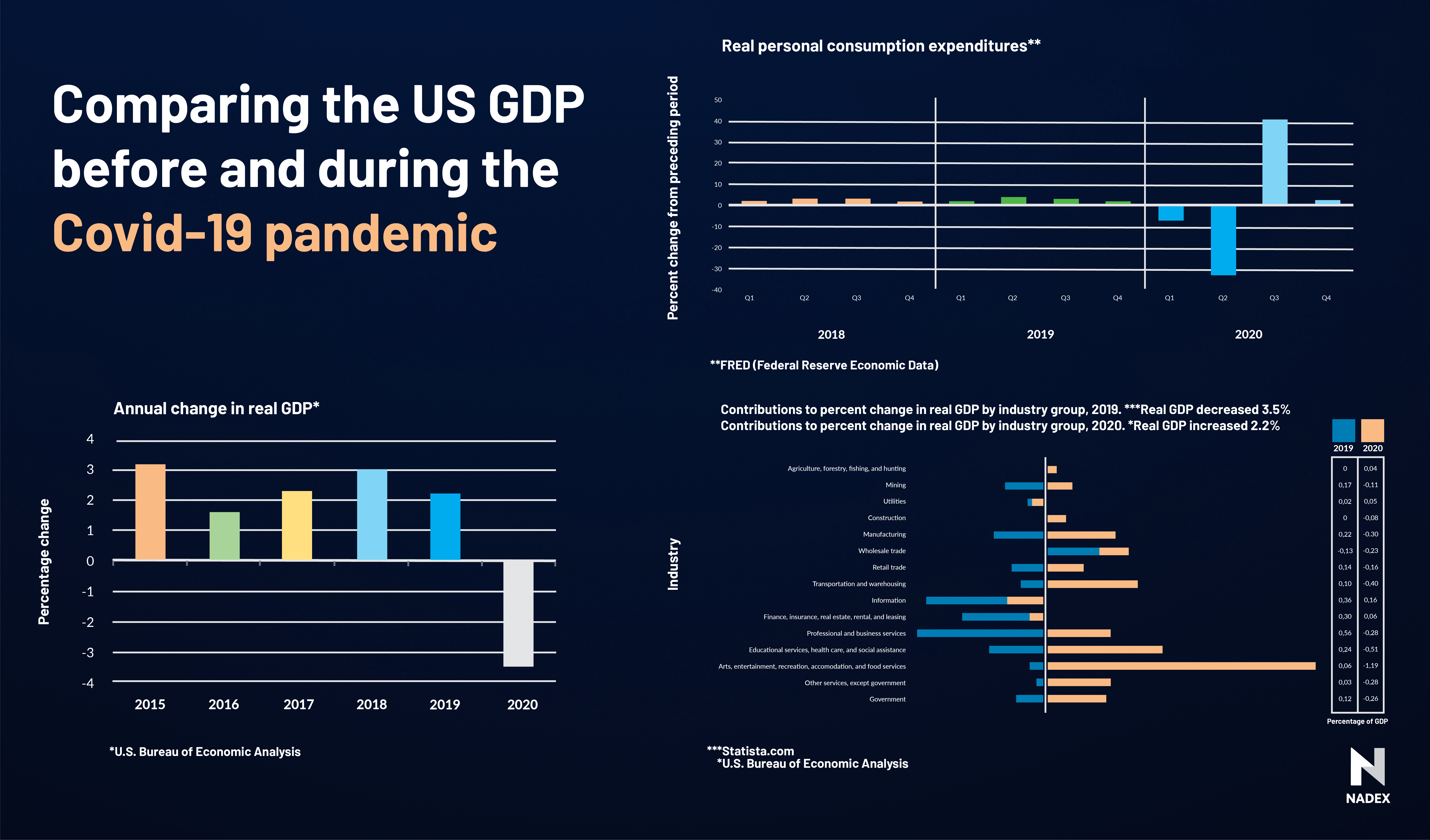

When comparing the pre-Covid-19 GDP to its current GDP, we can see how sharply the pandemic has impacted the US economy.

In 2020, real GDP decreased by 3.5% from the 2019 annual level, which is significant when compared to the 2.2% increase in 2019. Reduced consumer spending, exports, and business investment played a large part in this decline, with accommodation and food services accounting for the highest percentage reduction of 0.76%.[1]

The impact on unemployment rates and job losses

Every month, the U.S. Bureau of Labor Statistics releases the Employment Situation Summary. This report comprises two surveys conducted monthly:

The household survey, which measures labor force stats such as unemployment rates by demographic.

The establishment survey (also known as the Nonfarm payrolls report), which measures employment figures, hours, and earnings by industry.

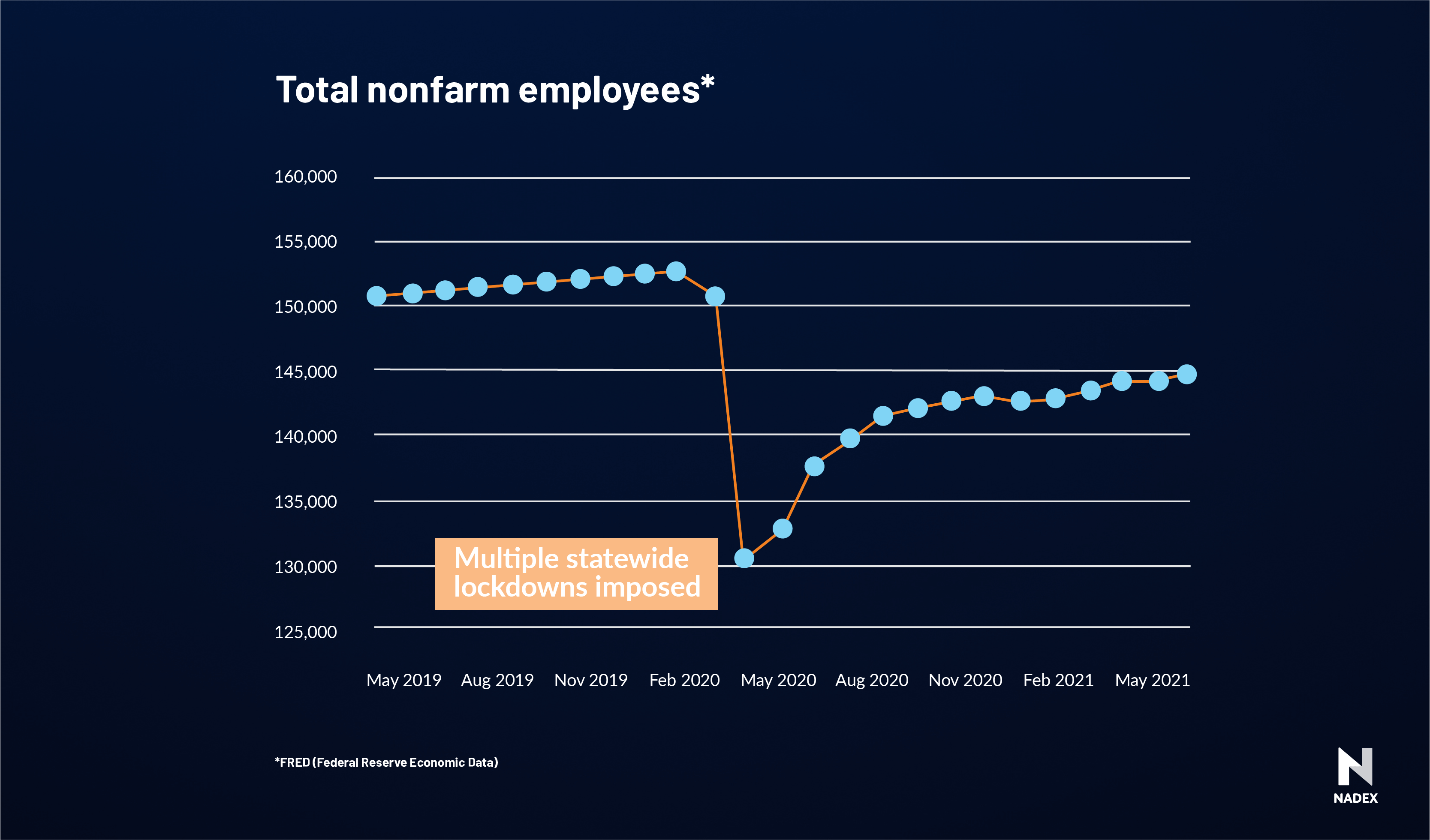

Looking at the June 2021 summary, which reflects data from May 2021, there’s a lot to be optimistic about. The unemployment rate dropped to 5.8% and total nonfarm payroll employment increased by 559,000. More than half of these new jobs came from the leisure and hospitality sector (292,000). Public and private education also made decent gains with 144,000 new jobs, as did the healthcare and social assistance sector with 46,000 jobs created.[2]

May’s total figure is double the gains seen in April’s increase of 278,000, but not quite at the levels hit in March, which saw the highest level of employment growth in the US in seven months. Considering the industries with the greatest share of growth, it’s likely these gains are the outcome of lower Covid-19 infection rates, the vaccine rollout, and the subsequent ease on business and education restrictions.

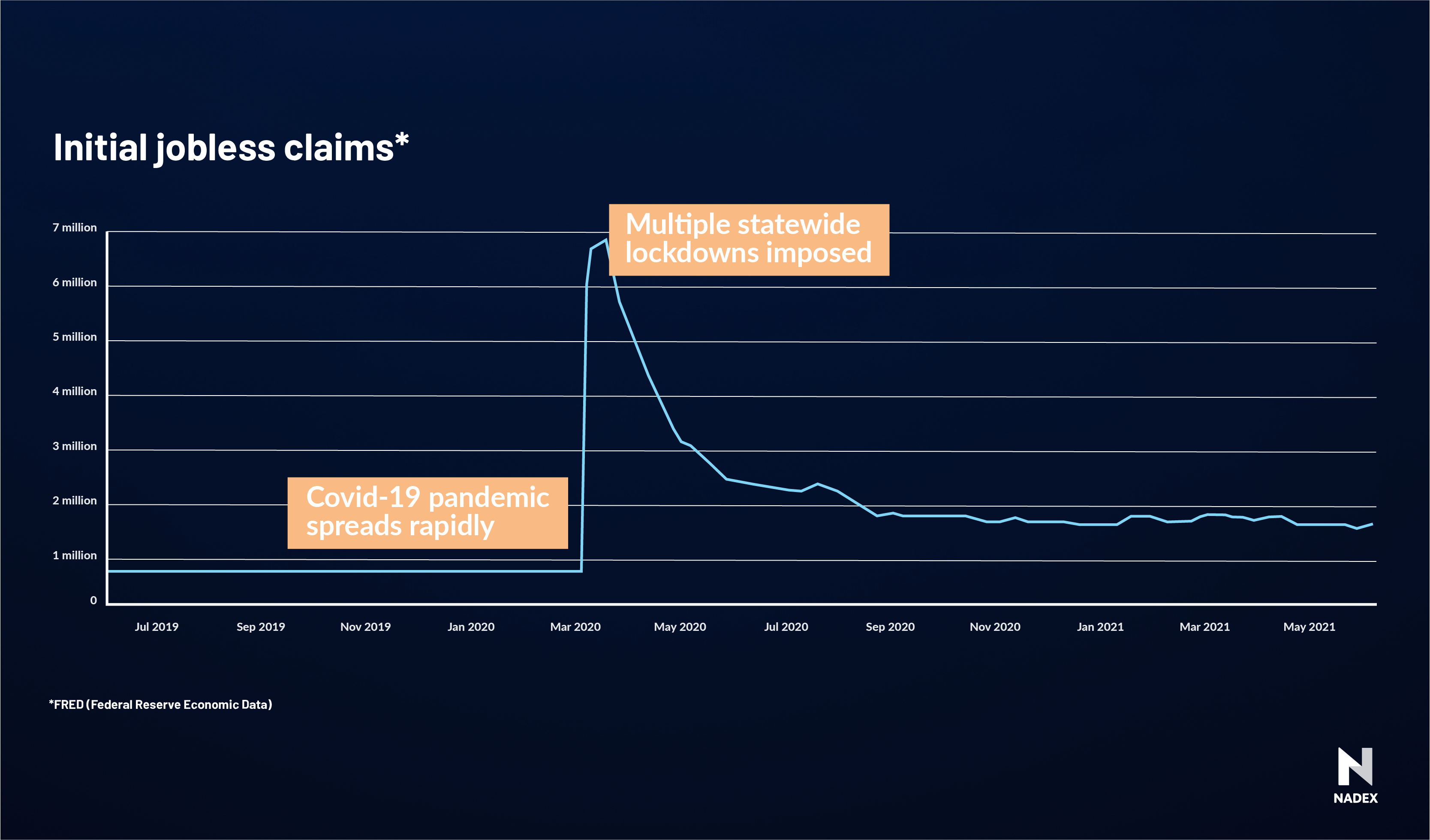

In the week ending May 29, 2021, the jobless claims report is just as positive – the number of Americans filing new unemployment claims dropped below 400,000 for the first time since the pandemic started.[3]

When we compare unemployment levels and jobless claims from May 2019 up to now, employment is once again on a steady incline, while jobless claims appear to be declining.

Chris Beauchamp remarks: “The US economy continues to grapple with Covid-19-related job losses, but the worst of the crisis appears to be behind us. Still, the scale of the challenge cannot be underestimated and it will be a long while before we get back to pre-crisis levels of employment.”

The impact of economic recovery on sectors

Technology

Tech is a hard-to-nail-down sector because it encompasses consumer goods, software, communication equipment, social media, programs, and more. Because it doesn’t quite fit into any one of the Bureau of Economic Activity’s industry groups, it’s difficult to quantify the precise effect it’s had on the US economy in the past year. But we do know the sector has seen enormous growth during the pandemic.

As the proverb goes: ‘Necessity is the mother of invention’ and with social distancing and restrictions, businesses have had to get creative in finding ways to reach their customers.

There’s no doubt tech is already changing consumers’ lives and with that, the US economy – forever. Kroger launched its KroGo shopping carts that come equipped with a scale and scanner to allow customers to skip the checkout line. Amazon, Google, General Motors, Tesla, and Apple are all competing in the multitrillion-dollar self-driving vehicle industry.

As expert analyst Guy Adami puts it:

“The greatest deflationary force throughout history has been technology. The events of the last year have only accelerated the use and acceptance of technology that was already in place. As this trend continues, the Federal Reserve will find itself in a bit of a conundrum with the forces of deflation against its goal of inflation. This leads to the unwanted outcome of inflation in all the wrong places.”

The growth in tech is likely to lead to low-income job losses as more professions become automated. In a recent McKinsey report, it’s estimated that up to 25% more workers might need to switch occupations by 2030 than before the pandemic.[4]

Finance expert Dan Nathan reminds us that what goes up must come down:

“If you traded during the late 1990s, you remember the inescapable feeling that we were on the precipice of something big – as in world-altering-technology big, and it was all coming pretty fast. Investors, analysts, and strategists had no clue how to value these companies in the private and public markets. An asset bubble ensued and many people got fabulously wealthy.

Most of the tech companies either went out of business or got swallowed up by the survivors of the ensuing bubble burst, and those remaining are trillion-dollar behemoths.

But there is a new group of upstarts, offering tech-like cloud-based software, streaming media, digital ads, and electric cars. The valuations make little sense in historical terms, and we know how periods of mass euphoria end: with economic recessions, protracted bear markets, and risk-asset bubbles overshooting to the downside just as they did to the upside.”

Energy

Energy consumption in the US decreased faster than the GDP in 2020. Energy delivered to the four end-use sectors (residential, commercial, transportation, and industrial) fell to 90% of its 2019 levels. The U.S. Energy Information Administration predicts the demand could return to those levels by either 2024, 2029, or 2050 – depending on the rate of US economic growth (based on high, low, and reference projections). [5]

Real estate

Real estate, rental, and leasing contributed 0.07% to 2020’s declined GDP, but is up 0.16% based on seasonal adjustments in Q4 from Q3 of 2020. Homeowners are once again putting their properties up for sale, and compared to a year ago, they’re selling them faster. This is due in large part to the lowest mortgage rates seen in nearly 50 years. However, lenders are wary, applying lessons learned from the housing crisis in the Great Recession, so buyers are finding it more difficult than before to get a mortgage.

Travel

Travel has arguably been the hardest-hit US industry since the start of the pandemic. A quick look at the revenue generated by travel and tourism in 2019 versus 2020 paints a bleak picture.

In 2019, domestic and international travel spending in the US amounted to over $1.1 trillion. In 2020, it dropped 42% to $680 billion – a loss of nearly $500 billion.

Before the pandemic, direct travel and travel-supported jobs accounted for 17% of the US workforce. However, 35% of all jobs lost were direct travel positions.

IG senior market analyst Joshua Mahony comments:

“Once we see vaccinations reach a critical juncture, the reopening of economies should help raise demand for both land and air travel. However, while airlines are currently desperate to fill any flights through lower prices, it’s likely they’ll seek to recover lost funds by raising margins once we see demand recover.”

Agriculture

One of the few sectors that contributed positively to 2020’s GDP was agriculture, forestry, fishing, and hunting. But that doesn’t mean the industry hasn’t had its fair share of challenges.

Before the pandemic hit, farmers were already trying to recover from extreme circumstances in recent years, like hurricanes, poor planting conditions, and export tariff cuts.

With people staying home more, it’s meant growing retail demand, yes – but vastly reduced demand from restaurants. Many farmers primarily supply hotels and food service outlets, which has left them with a surplus of meat and dairy. The decreased demand in agricultural commodities hit the sector hard.

And with people driving less, the demand for biofuels dropped, too, which led to a drop in the demand for corn used in these biofuels.[6]

However, in the case of corn, things are looking up. In fact, US corn prices finished at a six-year high at the end of 2020, largely due to the high demand from China and reduced supply from competing countries. Corn is also a major component in ethanol production (think hand sanitizer and fuel).

The impact of economic recovery on consumer behavior

Consumer behavior/spending activities

Consumer spending is a good way to track the health of an economy. When people spend more money, it acts as an early signal for economic growth, and vice versa – providing the amounts are within the range of ideal inflation. Before the coronavirus pandemic, consumer spending levels were within a sustainable range.

However, spending began to dip when the pandemic hit the US in Q1, and then fell drastically in Q2 of 2020, coinciding with businesses having to close shop due to the pandemic. In Q3, businesses in the food services, accommodation, and entertainment industries were allowed to open again, resulting in consumer spending rising by 41% from the previous quarter. The data for Q4, along with the March 2021 Consumer Confidence Index (which swelled to its highest reading in nearly a year), tells us that consumer spending levels may be approaching pre-Covid-19 levels – a good sign for the US economy.[7] [8]

Joshua Mahony notes:

“The restrictions seen throughout this crisis have created a two-tier scenario, where some struggle to get by, while others hoard money to spend down the line. Some will have invested in new houses or cars thanks to the money saved from a year with limited vacations and social activities. Hopefully, we’ll see a surge in spending once economies reopen. And, while sectors such as air travel will be unable to fully make up for lost sales, the feeling of restriction felt by many could ultimately drive higher demand as people seek to use their annual leave days before they run out.”

Consumer credit

It might be surprising to learn that American credit levels have remained fairly stable throughout most of the pandemic – and have actually seen a reduction this year.

In March 2021, bank deposits were at a record high as consumers cut their credit card debt by more than $120 billion since the pandemic began. Additional funding relief packages were approved by Congress and signed into law at the end of December 2020, and consumers used the extra money to pay off their debt. Federal Reserve data indicates that bank deposits have increased by nearly $3 trillion in the past year, which equates to around four years’ worth of savings in just 12 months. [3]

Consumer e-commerce activity

On consumer e-commerce activity, Joshua Mahony points out:

“Covid-19 has brought a greater reliance on digital shopping, with older generations forced into adapting to the new norms. While brick-and-mortar shops will hope that reopening efforts will lead to a rapid resumption of in-store shopping, there is going to be a permanent impact to this period as consumer behavior is adjusted.”

A recent McKinsey report confirms this, stating that e-commerce has grown 3.3 times faster than before the pandemic, and online sales now make up 20% of all retail sales in the US.[4]

How will US economic recovery affect the pound?

As the US economy makes a slow recovery, it will have an effect on other currencies that Nadex traders should be aware of, one of which is the GBP/USD pair. Using fundamental analysis, we can speculate on how the US economy may impact the British currency. However, keep in mind that the US dollar doesn’t exist in a vacuum – Britain’s economy (and others) will influence the GBP/USD too.

Inflation rates

The Federal Reserve aims to keep inflation close to 2% per annum, because when inflation stays low and holds steady, currency values tend to rise against other currencies. So if the US can maintain consistently low inflation rates, the dollar might see gains against the pound.

Interest rates

Higher interest rates attract foreign investment, which increases a currency’s value. If interest rates rise and inflation stays low in the country’s economic recovery, the US dollar may make gains against the pound.

US current account gap

A current account is effectively a country’s trade balance between its imports and exports of goods and services. If the current account balance is positive, it means the country is earning more than it’s spending. If it’s negative, it’s spending more than it’s earning, which leads to a current account deficit. The greater the deficit, the less attractive the country is to investors.

In Q4 2020, the US current account deficit reached its highest level since Q2 in 2007 of $188.5 billion, widening by $7.6 billion. This is equivalent to 3.5% of the country’s GDP. When looking at 2020 on an annual level, the current account gap increased by $167 billion – 3.1% of the US GDP.[3]

However, the US has historically had a stable history of trade surplus with the UK, so maintaining this will continue to have a positive effect on the USD.[9]

GDP and jobs

It goes without saying that countries with a higher GDP growth rate will see an increase in the value of their currency. So, if the US economy grows faster than the UK’s, it could strengthen the USD.

The same goes for the job market. Investors are more likely to put money into countries with a low unemployment rate. As of writing this, the UK’s unemployment rate was 5% while the US’ was 6% – the difference here may see the USD lose strength against the GBP if the UK continues to reduce unemployment faster than the US does.

How will US economic recovery affect crude oil prices?

When Covid-19 abruptly stopped economic activity globally and had everyone locked up in their homes, the demand for crude oil and petroleum products like jet fuel and gasoline saw a drastic decrease. But now, with the vaccine rollout around the world and demand once again increasing, the price of crude oil is going to see a rebound. As IG’s chief market analyst Chris Beauchamp points out:

“Oil prices have already enjoyed strong gains from late October, helped by expectations of a recovery in demand and OPEC’s decision to keep a lid on supply increases.”

We must also consider that the US is the world’s largest oil producer, and with the new trade agreement with China to increase petroleum exports to that country, this is likely to further raise crude oil prices.

US economic recovery from the coronavirus summed up

The Covid-19 economic downturn is quite different to any we’ve seen in the past. Unlike, say, the Great Depression in 1929 and the Great Recession in 2008, which were preceded by financial imbalances in banking and housing respectively, this downturn is a direct response to the pandemic. The entertainment and travel sectors, for example, have been unable to operate due to legal restrictions, leading to their decline.

The good news is that this economic contraction is unlikely to last as long as previous crashes, like the Great Depression, which continued throughout the 1930s – especially as vaccines are rolling out across the world. Unemployment rates are already declining, and the hardest-hit industries are slowly opening up again. So, while this economic downturn has been sharp and shocking, it’s likely going to be a lot shorter than many previous ones.

How to trade markets affected by Covid-19

Trade on the rise and fall of indices, commodities, forex, and economic events affected by the pandemic with Nadex. Take a stance on the outcome of events like the nonfarm payrolls report, weekly jobless claims, and GDP estimates. With Nadex Binary Options, you can predict the actual numbers of these events, giving you even more control over your trades.

[1] Bureau of Economic Analysis, April 2021

[2] U.S. Bureau of Labor Statistics, 2021

[3] Reuters, 2021

[4] McKinsey, The Future of Work After COVID-19 Report

[5] U.S. Energy Information Administration, April 2021

[6] U.S. Department of Agriculture

[7] FRED, April 2021

[8] OECD, April 2021

[9] United States Census Bureau, April 2021

Back to Blog

Back to Blog