All you need to know about stock market trading halts

Market-wide trading halts are happening more frequently during the outbreak of coronavirus (COVID-19). These types of halts are linked to heightened volatility, and can be triggered when:

Futures limits are reached

Circuit breaker levels are reached

Learn more about trading halts, how they’re triggered, and what they mean for you as a trader.

What are trading halts?

Market-wide trading halts happen when a particular market is suspended, triggered by a futures limit up, a futures limit down, or a circuit breaker. Trading is halted on any contracts based on the suspended markets too. These halts are regulatory in nature, keeping conditions fair and safe for traders.

While a trading halt might be disconcerting, it happens because market trading conditions would be unfair or unstable, or it might be unviable to trade for other regulatory reasons. As a trader, think of a trading halt as a necessary step to protect you while market conditions and securities are regulated.

During a trading halt, it’s important to understand that with Nadex it’s the underlying markets that are halted, so you won’t be able to trade that market – not on Nadex, or on any other exchange.

Why do trading halts happen?

Trading halts happen because a futures limit up or down has been reached, or a circuit breaker has been triggered. These are the two types of trading halts that occur during periods of volatility and can affect Nadex markets.

Futures limit up or limit down

Limit up or limit down refers to the maximum amount that prices can move during a trading session on a futures market. Limit up and limit down ranges are most relevant to Nadex markets based on stock index futures – let’s look at our US stock index futures contracts, based on the following underlying E-mini futures markets:

CME E-mini S&P 500® Index Futures – Nadex US 500 contracts

CME E-mini Nasdaq 100® Index Futures – Nadex US Tech 100 contracts

CME E-mini Russell 2000® Index Futures – Nadex US SmallCap 2000 contracts

CBOT E-mini Dow® Index Futures – Nadex Wall Street 30 contracts

Each of these markets has a 7% overnight (non-US trading hours) limit up or limit down level, with a 2-minute pause if a 3.5% up/down move is made. [1] These levels don’t automatically halt trading – if, for example, a limit down is reached, this just means the markets can’t trade any lower. However, a halt can occur on the underlying market if it remains at limit down and there is no movement. Consequently, we may not be able to list our contracts due to a lack of pricing in the underlying market. Here is an example of S&P 500 futures:

Circuit breakers

Different rules apply when markets are open, and circuit breakers can be triggered. Circuit breakers are predefined levels that will halt trading immediately if hit. When this happens on a stock index such as the S&P 500, a market-wide trading halt is triggered – and this means Nadex may not list contracts based on the affected indices either.

During US trading hours, from 8:30 a.m. – 2:25 p.m. CT, there are successive price limits in place corresponding to 7%, 13% and 20% declines below the previous trading day’s reference price. From 2:25 p.m. CT until the 3:00 p.m. CT close of the cash equity market, only the 20% price limit will be applicable. From 3:00 p.m. – 4:00 p.m. CT, there is a hard upside and downside limit of 7% based on the 3:00 p.m. reference price. The downside price limit, however, is either 7% below the 3:00 p.m. reference price OR the 20% price limit that applied before 3:00 p.m., whichever is closer to the 3:00 p.m. price.[1]

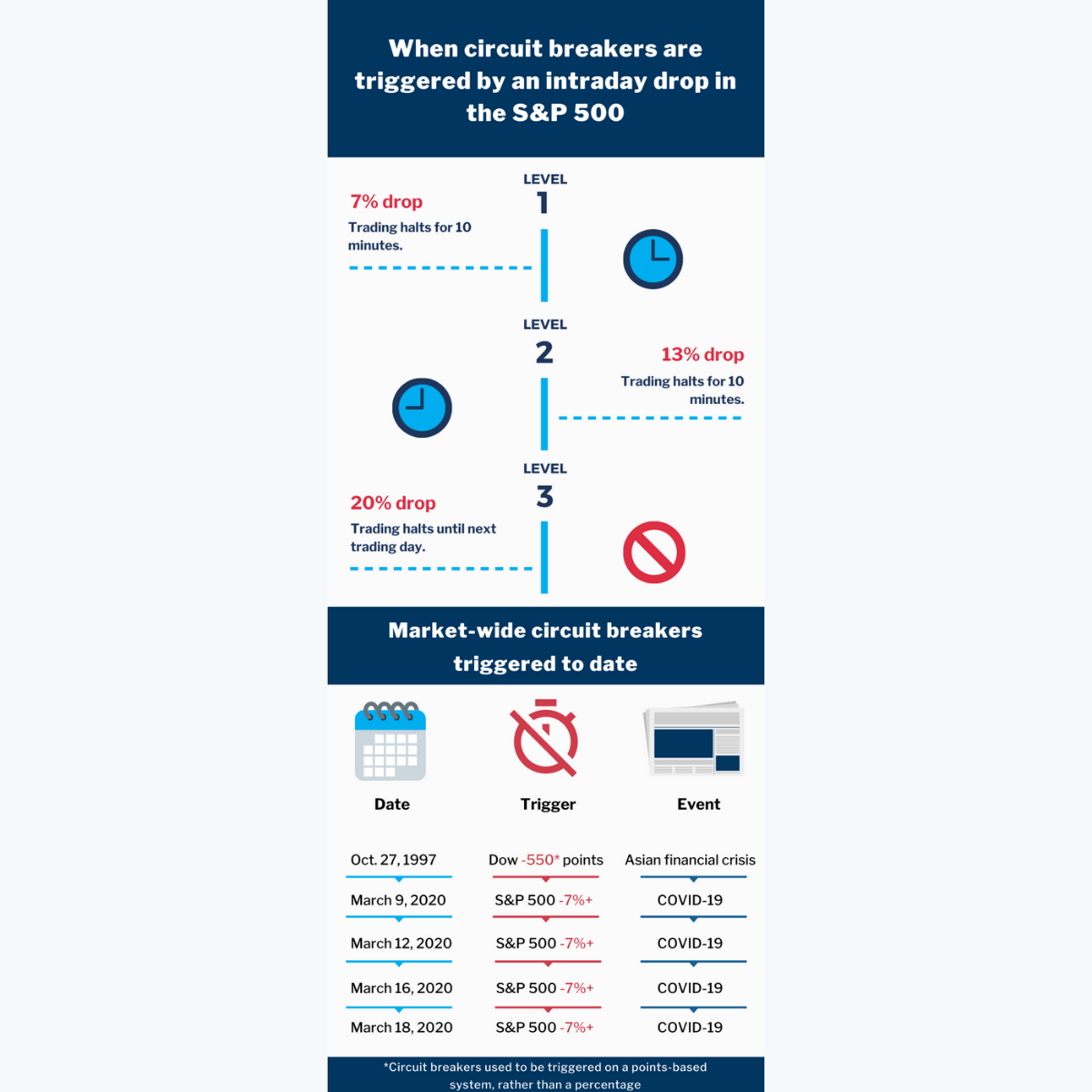

Let’s look at the S&P 500 in more detail as an example. These are the circuit breaker levels that would trigger trading halts:

Circuit breakers are rare, but as you can see from the table above, they have recently been happening more frequently. This is widely acknowledged to be linked to the highly volatile market conditions that have resulted from the coronavirus (COVID-19) pandemic.

What happens once the stock market is halted?

When a market is halted, no trading will happen on affected indices, so Nadex contracts may not be available either. If there’s a trading halt on Nadex, markets will be displayed as closed. If you have an order ticket open already, the ‘place order’ button won’t be available.

Trading halts don’t happen regularly, but when they do, it’s often under turbulent conditions and the halt can happen suddenly. We do our best to always keep you updated – the best way to find out what’s happening is on the Nadex platform. On the left-hand side of the platform, click on Updates, and then Trading Halt Status.

The trading halt status will have helpful information on the status of trading halts and exceeded price limits. In the event circuit breakers are triggered and trading is halted on any of our underlying markets, our status page will be updated in the following ways:

Trading Halts and Exceeded Price Limits will change from 'Operational' to 'Degraded Performance'

You will see the following information, with the applicable markets affected:

The underlying price has currently exceeded exchange price limits in the {market(s) affected}. During a trading halt and/or when underlying price limits are exceeded, Nadex markets may be unavailable for trading. For more information regarding price limits and trading halts, please review the article below and continue to monitor our status page for further updates.

How long do trading halts last?

A trading halt’s duration all depends on the reason behind it. The most consistent type of trading halt is the circuit breaker. Typically level 1 or level 2 circuit breakers during US hours will last for 10 minutes; however, depending on the conditions in the underlying stock indices, they may last longer in some instances. When a level 3 circuit breaker is triggered, trading will be halted until the next trading day.

The best course of action during any trading halt is to look out for communications from the exchange about how the situation is progressing.

Trading halts summary

While halts can disrupt your trading activity, it’s important to understand that they’ll protect you as a trader. A trading halt can signal a situation that needs to be regulated or corrected, which can cause unstable or unfair trading conditions. If you experience more trading halts during the current times of unprecedented volatility, please understand that the Nadex team, and regulators of our underlying markets, are acting in your best interests. Don’t forget to check the welcome message when you log in to the platform, keep an eye out for emails from us, and follow us on Twitter, Facebook, and Instagram. We’re always here to keep you updated on important market news and trading activity.

[1] https://www.cmegroup.com/trading/equity-index/faq-us-based-equity-index-price-limits.html

Back to Blog

Back to Blog