What’s so revolutionary about knock-outs? Think low upfront capital requirements. Think limited risk. Think simplicity. Tie that in with opportunities on the world’s most exciting markets. And you have it: Nadex Knock-Outs.

What are knock-outs?

Knock-outs are financial instruments that offer a set plan for every trade. Contracts come with a floor and ceiling built in – if either is hit by the indicative index price, you’re knocked out of the trade, taking your maximum profit or loss. If neither is hit, you can stay in the trade until expiry or close out early.

Knock-outs are also known as Touch Bracket™ contracts. They’re exclusive to Nadex, so you won’t find the same opportunities anywhere else.

‘What are Nadex Knock-Outs and how do they work?’ is a great place to start, teaching you the fundamentals and giving trading examples.

The benefits of trading knock-outs

Knock-outs offer a simple yet innovative way to trade. These are their key benefits:

Simple pricing

Limited risk

Clear profit targets

Popular markets

Flexible trading times

Great value – just like Nadex Binary Options and Call Spreads

Simple pricing

One of the key facets of a knock-out that separates it from a binary option is its pricing. The pricing of a contract tracks the indicative underlying market, moving with it one-for-one. The opportunity to make a profit comes if the market moves in the direction you predicted – it’s as simple as that.

A knock-out contract is structured with a floor and a ceiling, giving you a built-in trading plan. More on those next.

Limited risk

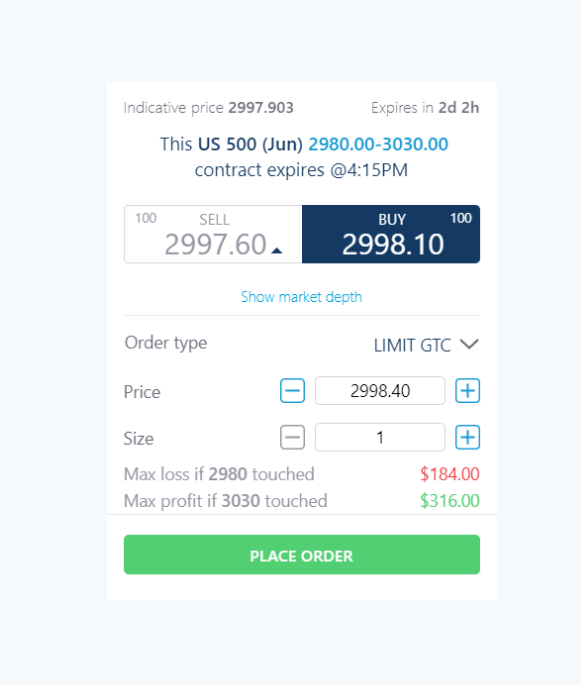

The limited risk element of knock-outs comes from their built-in floor and ceiling. The floor is the lowest number of the range displayed on an order ticket – here, your floor is 2980.00.

If you buy this contract and the market moves below 2980.00, you’ll be knocked out of the trade, taking your maximum possible loss of $184 (excluding exchange fees). Your losses are capped at this amount and you can never lose more than you put into the trade. If you want to limit your losses further you can close out early, too.

If you sell, the scenario swaps around: the ceiling becomes your maximum possible loss because you’re predicting the market will move down.

Clear profit targets

See the higher number on your order ticket? That’s the ceiling. In the example above, your ceiling is 3030.00 – say you buy the contract and the market moves beyond this number. You’ll be knocked out of the trade, making your maximum possible profit of $316 (excluding exchange fees). If you want to take your profit earlier, you can close out of the trade early.

When you sell a knock-out contract, the floor becomes your take profit level. If the market moves down as you predicted and reaches the floor, you’re knocked out of the trade, giving you your maximum possible profit.

Popular markets

You can trade knock-outs based on some of the world’s most popular markets, including:

Stock indices

Forex

Commodities

Knock-outs based on these markets give you a more accessible entry point than buying shares or trading futures. One share of a US 500 company could cost hundreds of dollars, whereas you could potentially enter a knock-out trade based on stock index futures for a fraction of that. Nadex contracts are focused on short term trading opportunities – there’s no buying and long-term holding here. Knock-out contracts last a maximum of a week and you can trade in and out as much as you like over this time. Want to trade with more capital? You can simply buy or sell more contracts. There’s a position limit of 100 on knock-out contracts.

Flexible trading times

You’re not restricted by typical stock exchange hours. For example, Nadex Knock-Out trading on the underlying Forex markets is available from 6 p.m. Monday through to 3 p.m. Friday. Your contract will expire at 3 p.m. Friday, unless you’re knocked out of the trade before this or you close out early.

Great value

Nadex has a $1 trading fee and a $1 settlement fee per contract, making knock-outs readily available to all traders. Plus, there’s no settlement fee unless you make a profit.

| Entry | $1 trading fee per contract |

| Exit before expiration | $1 trading fee per contract |

| Trade expiration – trader makes a profit | $1 settlement fee per contract |

| Trade expiration – trader makes a loss | No settlement fee |

Knock-outs: a revolutionary new trading experience

You can trade knock-outs on Nadex desktop and mobile platforms, giving you the flexibility to trade your way, anywhere you like.

If you haven’t already, check out our new trading platform. This is the platform of the future, where we’re developing a better trading experience for Nadex members. We’ll be making the full switch to our new platform soon – get in there first and explore the enhanced features, including better charting functionality and faster load speeds*.

*According to benchmark tests. Results may vary by client.

Try trading knock-outs for free

Open your Nadex demo account to practice trading knock-outs for free. You’ll get $10,000 in virtual funds to try out our flexible contracts.

Learn to trade with Nadex

Learn how to trade knock-outs

Explore our education center

See our videos on YouTube

Back to Blog

Back to Blog