Access crypto derivatives at Crypto.com

Nadex's crypto derivatives allow traders to potentially profit and hedge against price movements. You can also implement a wide-range of trading strategies with our defined risk contracts.

Key benefits

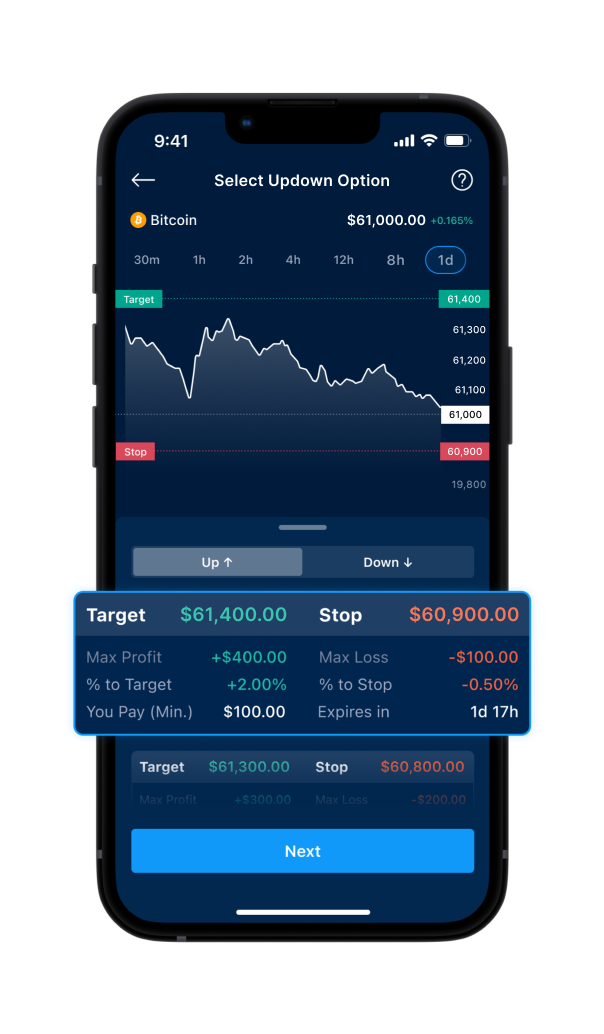

Hedge against price declines and short the underlying market using UpDown Options.

Capture price action and gain exposure to a token without needing to own the asset itself.

UpDown Options have a clearly defined profit target and stop loss level built into the contract. You always know your max profit and loss before entering a trade.

How to trade crypto UpDown Options

Use our interactive, real-world demonstration below to learn how to trade crypto UpDown Option contracts.

Cryptocurrency Contract Specifications

| Bitcoin | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 1 |

| Number of contracts | 4 |

| Range | $500 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex BTC Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Bitcoin | |

|---|---|

| Tick value | $0.50 |

| Minimum tick size | 1 |

| Number of contracts | 4 |

| Range | $2000 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex BTC Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Ethereum | |

|---|---|

| Tick value | $2.50 |

| Minimum tick size | 1 |

| Number of contracts | 4 |

| Range | $100 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex ETH Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Litecoin | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.02 |

| Number of contracts | 4 |

| Range | $2 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex LTC Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Bitcoin Cash | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.10 |

| Number of contracts | 4 |

| Range | $10 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex BCH Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Dogecoin | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.00005 |

| Number of contracts | 4 |

| Range | $0.005 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex DOGE Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Avalanche | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.005 |

| Number of contracts | 4 |

| Range | $0.50 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex AVAX Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Chainlink | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.004 |

| Number of contracts | 4 |

| Range | $0.40 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex LINK Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Polkadot | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.002 |

| Number of contracts | 4 |

| Range | $0.20 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex DOT Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Shiba Inu | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.00000001 |

| Number of contracts | 4 |

| Range | $0.000001 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex SHIB Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Stellar | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.0005 |

| Number of contracts | 4 |

| Range | $0.05 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex XLM Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| HBAR | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.0001 |

| Number of contracts | 4 |

| Range | $0.01 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex HBAR Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| CRO | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.0001 |

| Number of contracts | 4 |

| Range | $0.01 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex CRO Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| BONK | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.00000002 |

| Number of contracts | 4 |

| Range | $0.000002 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex BONK Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| FLOKI | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.00000005 |

| Number of contracts | 4 |

| Range | $0.000005 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex FLOKI Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| PEPE | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.000000005 |

| Number of contracts | 4 |

| Range | $0.0000005 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex PEPE Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| SOLANA | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.05 |

| Number of contracts | 4 |

| Range | $5 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex SOL Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| ADA | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.0004 |

| Number of contracts | 4 |

| Range | $0.04 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex ADA Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| XRP | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.001 |

| Number of contracts | 4 |

| Range | $0.1 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex XRP Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Bitcoin | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 5 minutes starting at 5:05am on Saturday; Saturday’s final expiration at 4am |

| Contract Duration | 5-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 5 |

| Strike Width | 25 |

| Position Limit | 25,000 |

| Underlying Market | Nadex BTC Index |

| Settlement Currency | USD |

| Bitcoin | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 40 |

| Position Limit | 25,000 |

| Underlying Market | Nadex BTC Index |

| Settlement Currency | USD |

| Bitcoin | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 80 |

| Position Limit | 25,000 |

| Underlying Market | Nadex BTC Index |

| Settlement Currency | USD |

| Ethereum | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 5 minutes starting at 5:05am on Saturday; Saturday’s final expiration at 4am |

| Contract Duration | 5-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 5 |

| Strike Width | 2 |

| Position Limit | 25,000 |

| Underlying Market | Nadex ETH Index |

| Settlement Currency | USD |

| Ethereum | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 3 |

| Position Limit | 25,000 |

| Underlying Market | Nadex ETH Index |

| Settlement Currency | USD |

| Ethereum | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 7 |

| Position Limit | 25,000 |

| Underlying Market | Nadex ETH Index |

| Settlement Currency | USD |

| Litecoin | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.1 |

| Position Limit | 25,000 |

| Underlying Market | Nadex LTC Index |

| Settlement Currency | USD |

| Litecoin | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.20 |

| Position Limit | 25,000 |

| Underlying Market | Nadex LTC Index |

| Settlement Currency | USD |

| Bitcoin Cash | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.8 |

| Position Limit | 25,000 |

| Underlying Market | Nadex BCH Index |

| Settlement Currency | USD |

| Bitcoin Cash | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 2 |

| Position Limit | 25,000 |

| Underlying Market | Nadex BCH Index |

| Settlement Currency | USD |

| Dogecoin | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0003 |

| Position Limit | 25,000 |

| Underlying Market | Nadex DOGE Index |

| Settlement Currency | USD |

| Dogecoin | |

|---|---|

| Expirations (Eastern time) | Saturday 5am |

| Open time (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.00070 |

| Position Limit | 25,000 |

| Underlying Market | Nadex DOGE Index |

| Settlement Currency | USD |

| Avalanche | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.05 |

| Position Limit | 25,000 |

| Underlying Market | Nadex AVAX Index |

| Settlement Currency | USD |

| Avalanche | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.15 |

| Position Limit | 25,000 |

| Underlying Market | Nadex AVAX Index |

| Settlement Currency | USD |

| Chainlink | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.02 |

| Position Limit | 25,000 |

| Underlying Market | Nadex LINK Index |

| Settlement Currency | USD |

| Chainlink | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.05 |

| Position Limit | 25,000 |

| Underlying Market | Nadex LINK Index |

| Settlement Currency | USD |

| Polkadot | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.01 |

| Position Limit | 25,000 |

| Underlying Market | Nadex DOT Index |

| Settlement Currency | USD |

| Polkadot | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.02 |

| Position Limit | 25,000 |

| Underlying Market | Nadex DOT Index |

| Settlement Currency | USD |

| Shiba Inu | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.00000004 |

| Position Limit | 25,000 |

| Underlying Market | Nadex SHIB Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| Shiba Inu | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0000001 |

| Position Limit | 25,000 |

| Underlying Market | Nadex SHIB Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| Stellar | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0002 |

| Position Limit | 25,000 |

| Underlying Market | Nadex XLM Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| Stellar | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0006 |

| Position Limit | 25,000 |

| Underlying Market | Nadex XLM Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| HBAR | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0002 |

| Position Limit | 25,000 |

| Underlying Market | Nadex HBAR Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| HBAR | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0004 |

| Position Limit | 25,000 |

| Underlying Market | Nadex HBAR Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| BONK | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0000001 |

| Position Limit | 25,000 |

| Underlying Market | Nadex BONK Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| BONK | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.00000024 |

| Position Limit | 25,000 |

| Underlying Market | Nadex BONK Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| FLOKI | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.00000043 |

| Position Limit | 25,000 |

| Underlying Market | Nadex FLOKI Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| FLOKI | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.000001 |

| Position Limit | 25,000 |

| Underlying Market | Nadex FLOKI Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| CRO | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0003 |

| Position Limit | 25,000 |

| Underlying Market | Nadex CRO Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| CRO | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0008 |

| Position Limit | 25,000 |

| Underlying Market | Nadex CRO Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| PEPE | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.000000044 |

| Position Limit | 25,000 |

| Underlying Market | Nadex PEPE Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| PEPE | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0000001 |

| Position Limit | 25,000 |

| Underlying Market | Nadex PEPE Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| SOLANA | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.3 |

| Position Limit | 25,000 |

| Underlying Market | Nadex SOL Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| SOLANA | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.07 |

| Position Limit | 25,000 |

| Underlying Market | Nadex SOL Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| ADA | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.002 |

| Position Limit | 25,000 |

| Underlying Market | Nadex ADA Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| ADA | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.005 |

| Position Limit | 25,000 |

| Underlying Market | Nadex ADA Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| XRP | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Every 20-minute starting at 5:20am on Saturday; Saturday's final expiration at 4am |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.004 |

| Position Limit | 25,000 |

| Underlying Market | Nadex XRP Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| XRP | |

|---|---|

| Open time (Eastern time) | Saturday 5am |

| Expirations (Eastern time) | Hourly, Saturday 7am-Saturday 4am |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.01 |

| Position Limit | 25,000 |

| Underlying Market | Nadex XRP Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

*Crypto derivatives open for trading at 5am ET on Saturday and expire at 4am ET the following Saturday. Please note, Crypto UpDowns will expire early if the floor or ceiling is touched beforehand.

Download the Crypto.com App