Access crypto derivatives at Crypto.com

Nadex's crypto derivatives allow traders to potentially profit and hedge against price movements. You can also implement a wide-range of trading strategies with our defined risk contracts.

Key benefits

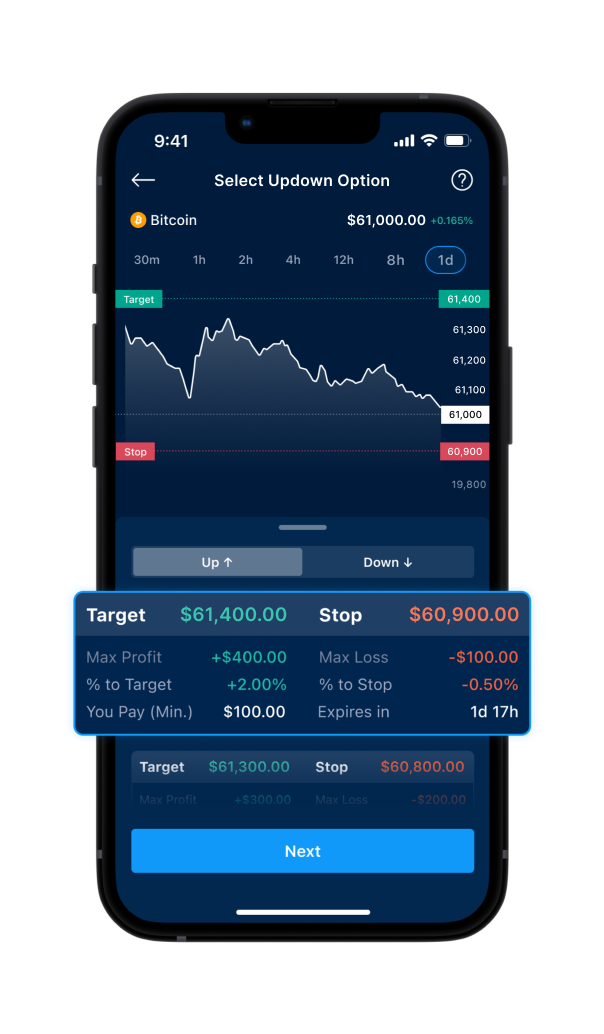

Hedge against price declines and short the underlying market using UpDown Options.

Capture price action and gain exposure to a token without needing to own the asset itself.

UpDown Options have a clearly defined profit target and stop loss level built into the contract. You always know your max profit and loss before entering a trade.

How to trade crypto UpDown Options

Use our interactive, real-world demonstration below to learn how to trade crypto UpDown Option contracts.

Cryptocurrency Contract Specifications

| Bitcoin | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 1 |

| Number of contracts | 4 |

| Range | $500 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex BTC Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Bitcoin | |

|---|---|

| Tick value | $0.50 |

| Minimum tick size | 1 |

| Number of contracts | 4 |

| Range | $2000 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex BTC Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Ethereum | |

|---|---|

| Tick value | $2.50 |

| Minimum tick size | 1 |

| Number of contracts | 4 |

| Range | $100 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex ETH Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Litecoin | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.02 |

| Number of contracts | 4 |

| Range | $2 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex LTC Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Bitcoin Cash | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.10 |

| Number of contracts | 4 |

| Range | $10 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex BCH Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Dogecoin | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.00005 |

| Number of contracts | 4 |

| Range | $0.005 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex DOGE Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Avalanche | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.005 |

| Number of contracts | 4 |

| Range | $0.50 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex AVAX Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Chainlink | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.004 |

| Number of contracts | 4 |

| Range | $0.40 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex LINK Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Polkadot | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.002 |

| Number of contracts | 4 |

| Range | $0.20 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex DOT Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Shiba Inu | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.000000010 |

| Number of contracts | 4 |

| Range | $0.0000010 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex SHIB Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Stellar | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.00005 |

| Number of contracts | 4 |

| Range | $0.005 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex XLM Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| HBAR | |

|---|---|

| Tick value | $1 |

| Minimum tick size | 0.000025 |

| Number of contracts | 4 |

| Range | $0.0025 |

| Expiration | Weekly or when floor/ceiling touched |

| Position limit | 250 |

| Underlying market | Nadex HBAR Index |

| Settlement | Cash-settled |

| Trading hours | 24/7* |

| Bitcoin | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 5 minutes starting at 11:05pm on Friday; Friday’s final expiration at 4pm |

| Contract Duration | 5-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 5 |

| Strike Width | 25 |

| Position Limit | 25000 |

| Underlying Market | Nadex BTC Index |

| Settlement Currency | USD |

| Bitcoin | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 40 |

| Position Limit | 25000 |

| Underlying Market | Nadex BTC Index |

| Settlement Currency | USD |

| Bitcoin | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am-Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 80 |

| Position Limit | 25000 |

| Underlying Market | Nadex BTC Index |

| Settlement Currency | USD |

| Ethereum | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 5 minutes starting at 11:05pm on Friday; Friday’s final expiration at 4pm |

| Contract Duration | 5-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 5 |

| Strike Width | 2 |

| Position Limit | 25000 |

| Underlying Market | Nadex ETH Index |

| Settlement Currency | USD |

| Ethereum | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 3 |

| Position Limit | 25000 |

| Underlying Market | Nadex ETH Index |

| Settlement Currency | USD |

| Ethereum | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am-Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 7 |

| Position Limit | 25000 |

| Underlying Market | Nadex ETH Index |

| Settlement Currency | USD |

| Litecoin | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.1 |

| Position Limit | 25000 |

| Underlying Market | Nadex LTC Index |

| Settlement Currency | USD |

| Litecoin | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am-Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.20 |

| Position Limit | 25000 |

| Underlying Market | Nadex LTC Index |

| Settlement Currency | USD |

| Bitcoin Cash | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.8 |

| Position Limit | 25000 |

| Underlying Market | Nadex BCH Index |

| Settlement Currency | USD |

| Bitcoin Cash | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am-Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 2 |

| Position Limit | 25000 |

| Underlying Market | Nadex BCH Index |

| Settlement Currency | USD |

| Dogecoin | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0003 |

| Position Limit | 25000 |

| Underlying Market | Nadex DOGE Index |

| Settlement Currency | USD |

| Dogecoin | |

|---|---|

| Expirations (Eastern time) | Friday 11pm |

| Open time (Eastern time) | Hourly, Saturday 1am - Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.00070 |

| Position Limit | 25000 |

| Underlying Market | Nadex DOGE Index |

| Settlement Currency | USD |

| Avalanche | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.05 |

| Position Limit | 25000 |

| Underlying Market | Nadex AVAX Index |

| Settlement Currency | USD |

| Avalanche | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am - Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.15 |

| Position Limit | 25000 |

| Underlying Market | Nadex AVAX Index |

| Settlement Currency | USD |

| Chainlink | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.02 |

| Position Limit | 25000 |

| Underlying Market | Nadex LINK Index |

| Settlement Currency | USD |

| Chainlink | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am - Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.05 |

| Position Limit | 25000 |

| Underlying Market | Nadex LINK Index |

| Settlement Currency | USD |

| Polkadot | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm on Friday; Friday's final expiration at 4pm |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.01 |

| Position Limit | 25000 |

| Underlying Market | Nadex DOT Index |

| Settlement Currency | USD |

| Polkadot | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am - Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.02 |

| Position Limit | 25000 |

| Underlying Market | Nadex DOT Index |

| Settlement Currency | USD |

| Shiba Inu | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm Friday - 4pm the following Firday |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.00000004 |

| Position Limit | 25000 |

| Underlying Market | Nadex SHIB Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| Shiba Inu | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am - Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0000001 |

| Position Limit | 25000 |

| Underlying Market | Nadex SHIB Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| Stellar | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm Friday - 4pm the following Firday |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0001 |

| Position Limit | 25000 |

| Underlying Market | Nadex XLM Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| Stellar | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am - Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0003 |

| Position Limit | 25000 |

| Underlying Market | Nadex XLM Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| HBAR | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Every 20 minute starting at 11:20pm Friday - 4pm the following Firday |

| Contract Duration | 20-minutes |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0002 |

| Position Limit | 25000 |

| Underlying Market | Nadex HBAR Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

| HBAR | |

|---|---|

| Open time (Eastern time) | Friday 11pm |

| Expirations (Eastern time) | Hourly, Saturday 1am - Friday 4pm |

| Contract Duration | 2-hour |

| Trading Hours | 24/7* |

| Contract Value | $10 |

| Tick Size | 0.1 |

| Tick Value | $0.10 |

| Number of Strikes | 9 |

| Strike Width | 0.0004 |

| Position Limit | 25000 |

| Underlying Market | Nadex HBAR Index |

| Settlement Method | Cash-settled |

| Settlement Currency | USD |

*Crypto derivatives open for trading at 11pm ET on Friday and expire at 4:15pm ET the following Friday. Please note, Crypto UpDowns will expire early if the floor or ceiling is touched beforehand.

Download the Crypto.com App