How to trade forex with binary options

What is forex and how do you trade it? This is one of the key questions that new traders want answered. The currency market, also known as foreign exchange (hence forex), is the world’s largest market with $3-5 trillion traded daily. There are many opportunities for individuals – it’s not just for big banks and funds. Learn more about the forex market, what it is, and how you can trade it with binary option contracts.

What is forex trading?

Forex trading, in simplest terms, involves buying one currency and selling another – this is known as a foreign exchange spot transaction. Traders can also access the forex market without taking ownership of the currency itself, from trading futures contracts to speculating on price action with binary options.

Here’s how it works: suppose you’re buying EUR/USD in the spot market. This means you are effectively buying EUR, while simultaneously funding that trade with USD. In the case of selling EUR/GBP, you are effectively selling EUR and backing that trade with GBP, meaning you believe the value of the EUR will decrease relative to the GBP.

If you’re speculating on the forex market with a financial instrument such as a binary option, you will be able to make predictions on a range of currency pairs – you won’t own the underlying asset, so costs are low and opportunities are plentiful. Binary options offer you fixed risk, so you will know your maximum possible profit and loss before you trade. You can find excellent risk-to-reward ratios on contracts.

How does forex trading work?

Forex trading is facilitated through currency pairs: it’s important you understand this principle for any forex trade you place. To give a brief overview:

Currencies are always quoted in pairs. The first currency is called the base currency, the second is called the quote currency.

When looking at a chart of currency pairs, it will be reflective of the movement of the base currency, relative to the second named or quote currency.

It is always assumed that the base currency is worth one. So if EUR/USD = 1.11, this means there are 1.11 US dollars to one euro.

Currencies are traded in pairs too. You will see them listed on the Nadex platform in the format of base currency and quote currency. If you see the strike EUR/USD > 1.1080, the pricing will reflect the market-perceived probability of one euro being worth more than 1.1080 USD at expiration. If you agree it will be worth more, you buy. If you disagree it will be worth more, you sell.

What forex pairs can you trade on Nadex?

With Nadex, you can trade 11 forex pairs, which are:

EUR/USD – Euro-US Dollar

AUD/USD – Australian Dollar-US Dollar

USD/JPY – US Dollar-Japanese Yen

GBP/USD – British Pound-US Dollar

USD/CHF – US Dollar-Swiss Franc

EUR/GBP – Euro-British Pound

USD/CAD – US Dollar-Canadian Dollar

AUD/JPY – Australian Dollar-Japanese Yen

GBP/JPY – British Pound-Japanese Yen

EUR/JPY – Euro-Japanese Yen

USD/MXN – US Dollar-Mexican Peso

Forex trading sessions

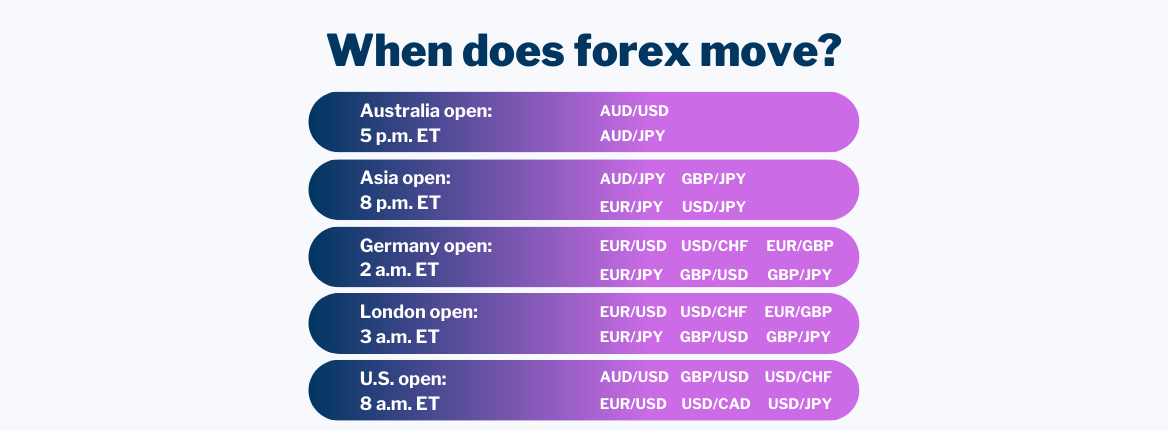

One of the reasons why traders choose forex is that there are opportunities around the clock. As different markets open, you can trade binary option contracts based on the various currencies, with short-term and longer-term options available.

8 a.m. ET is considered the time the cash market opens, as this is the time of the U.S. market opening. You can access greater degrees of volatility across the board at this time.

Here is a summary of forex market opening times, when you can expect more opportunities to trade:

Trading time frames with Nadex

With Nadex, there are multiple time frames in which you can trade. There are short-term intraday contracts, through to daily and even weekly durations. This provides a great deal of flexibility to satisfy any trading style.

Whether you are an ‘edge-of-your-seat’ type of trader looking for second-by-second opportunities, more of a day trader, or even a swing trader, there is a contract suited to you.

With markets trading 23 hours per day, Sunday afternoon through Friday afternoon, there will be opportunity on your schedule.

Additionally, because there is no pattern day trader rule, you are free to trade as often as you like, no matter your account size.

How to trade forex binary options

Now you have a good overview of the forex market and what it means to trade it with binary options. If you want to become an expert on binary option contracts so you can trade forex with confidence, you’ve come to the right place. Each day, there are binary option contracts available to trade on Nadex that are based on the forex market. Nadex offers fixed risk and the option to trade forex with low capital, so it’s a great way to access the foreign exchange market.

Learn to trade forex binary options.

You will pick up all the basics, plus you’ll get familiar with specific strategies to help you progress as a binary option trader.

Binary Options FAQs

What are binary options?

Binary options are a financial instrument that provide a fixed payout if the underlying market moves beyond the strike price. You decide whether a market is likely to be above a certain price, at a certain time. Trading a binary option is like asking a simple question: will this market be above this price at this time? If you think yes, you buy, and if you think no, you sell. Nadex Binary Options enable traders to predict the outcome of an underlying market’s movement. Learn more about how binary options work.

How do binary options work?

There are three key elements that make up a binary option contract:

The underlying market. This is the market you choose to trade.

The strike price. The strike price is central to the binary option decision-making process – to place a trade, you must decide if you think the underlying market will be above or below the strike.

The expiration date and time. You can trade binary options lasting for up to one week, with durations as short as five minutes.

Learn more about how binary options work.

Are binary options legal?

Yes, binary options are legal to trade with a regulated provider in the US. It’s not just legal to trade binary options in the US – it’s regulated, has low capital requirements, and is accessible to retail traders. Look out for CFTC regulation to make sure the exchange you are trading on has legal oversight to protect you against unscrupulous market practices. Additionally, ensure the exchange is based in the US and that you trade your own account. Learn more about how binary options are regulated.

Is binary options trading risky?

It can be! Here are some steps to follow so that you can trade binary options more securely:

Only trade with a CFTC regulated exchange.

Don’t engage with anybody who claims to be a broker, or who says they can trade your account for you.

Trade your own account.

Try trading binary options on a regulated exchange for free! The best way to trade more confidently is through practice on our binary options demo account with $10,000 in virtual funds.

How do binary traders make money?

Binary traders can make money by correctly predicting whether a market will be above a specific price at a specific time. At expiration, you either make a predefined profit or you lose the money you paid to open the trade. Binary options are priced between $0 and $100. Each contract will show you the maximum you could gain and the maximum you could lose. If your trade is successful, you receive a $100 payout, so your profit will be $100 minus the money you paid to open the trade. If your trade isn’t successful, you don’t receive a payout. This means you lost your capital, but nothing else, because your risk is capped.

What's the difference between options and binary options?

Binary options are short-term, limited risk contracts with two possible outcomes at expiration – you either make a predefined profit or you lose the money you paid to open the trade. The payoff is fixed on either side of the strike price. Options, also called vanilla options, have a payout that is dependent on the difference of the strike price of the option and the price of the underlying asset on one side of the strike price while fixed on the other. Options can be complex, difficult to price, and have the potential for outsized profits or losses.

What's the minimum deposit for a binary options trade?

At Nadex, you can open a live account for free - that's right, no minimum deposit required. Binary trades at Nadex are priced between $0 and $100, excluding exchange fees. The cost to place a trade is always equal to the maximum risk, plus any trade fees, which is required to be in your account when the order is placed. Not ready for a live account? You can practice trading binary options for free with our binary options demo account.

Back to Help

Back to Help