Implied Probability ITM

The Implied Probability ITM (in-the-money) tool calculates the midpoint between the current bid and offer prices. The midpoint can be used as an indication of the implied probability of a trade potentially finishing ITM at the moment you enter the position, and receiving the full $100 payout per contract. Nadex provides no guarantee of profit and assumes no liability for trading decisions based on this Implied Probability ITM tool. As always, any trading decisions you make are solely your responsibility and at your own risk.

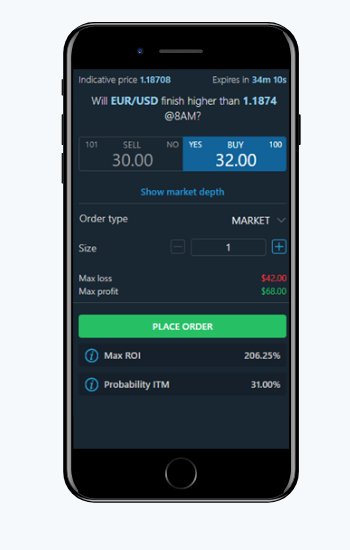

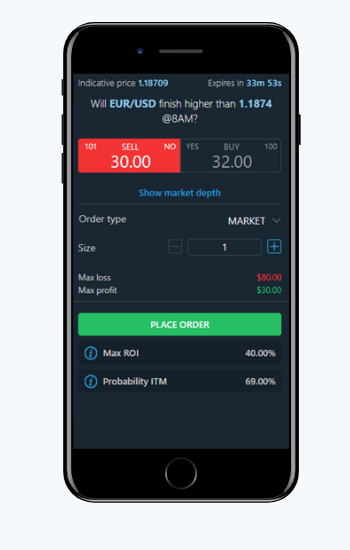

Let’s take a closer look at this tool. Below are order tickets from both a buyer and seller’s perspective. You’ll see a distinct difference between the buyer and seller’s probability of finishing in-the-money on this contract.

The buyer has a 31% probability of being correct at expiration. As you can see by the indicative price (1.18708) the market needs to move up and finish above the strike price of 1.1874 by expiration in order to be correct. Therefore both the cost of the contract ($32.00) is cheaper and the max ROI is much higher for the buyer because the probability of being correct at expiration is much lower.

The seller, who has the advantage since the market is trading below the strike price, is going to pay more to enter this trade with a lower ROI – but a significantly higher likelihood of being correct at expiration.

A buyer has a 31% probability of finishing ITM at expiration.

Buy Side Calculation: (32 + 30)/2 = 31%

A seller has a 69% probability of finishing ITM at expiration. Or more simply, the inverse of the buy-side.

Sell Side Calculation ((32.00+30.00)/2) – 100 = 69%

It’s important to always consider the context of a trade as well. For example, you will probably notice a significant difference in how quickly the Implied Probability ITM rate can change when trading a 5-minute binary option versus a 2 hour, daily or weekly binary option. 5-minute binary pricing is much more susceptible to small movements in the underlying market and time decay – for better and for worse at times! So we always encourage you to keep that in mind and continue using other tools when setting up your trade.

Trade in and out of positions

Remember, you don’t have to hold the contract until expiration. You can trade in and out of a position throughout the lifetime of the contract.

Let’s take a look at another example. Here we decided to go long and buy the contract for $33.00, and the implied probability of finishing ITM is 30% at the time of entering the trade.

However, as an informed trader, you may like this entry price for a variety of reasons the upcoming release of initial jobless claims data, a major US stock earnings report, a geopolitical event (US Election, Brexit), and so on. You may like the technical analysis tools telling you the market is oversold/overbought. Or we may just simply like the upside at the price point. Whatever your decision, it’s doesn’t have to be all-or-nothing with Nadex Binary Options.

As time carries on and as the clock nears expiration with 1 hour and 48 minutes left, you decide it’s time to take your profits. You can click the ‘Close’ button next to your open position, then select ‘Close Position’ – capturing a $6.00 profit.

Feel free to reach out to our team with any questions at customerservice@nadex.com!

MORE ON PLATFORM TUTORIALS

Nadex 5-minute binary options explained How to research and trade Nadex Knock-Outs How to set up technical indicators and drawing tools Go long or short oil using Nadex Binary Options How to short the S&P 500 using Nadex Binary Options Trading the price of oil using Nadex Knock-Outs Researching opportunities on the new Nadex platform Placing an order on the new Nadex platform Executing a trade and managing a position on the new Nadex platform New Nadex platform walkthrough Trading with NadexGO™: our mobile app walkthrough Max ROI

Back to Help

Back to Help